Refinancing Installment Loans, Credit Impact, and More

Can you refinance a traditional installment loan?

At Security Finance, if you need additional cash prior to paying off your loan in full, you may qualify for another loan. A Security Finance team member can help you with this request. When you refinance an installment loan, the proceeds of the new loan will pay off the original loan and you will receive the remaining proceeds. This new loan will be paid over a new fixed-term as specified in the contract.

Annual Percentage Rate (APR) – What To Know Before You Owe!

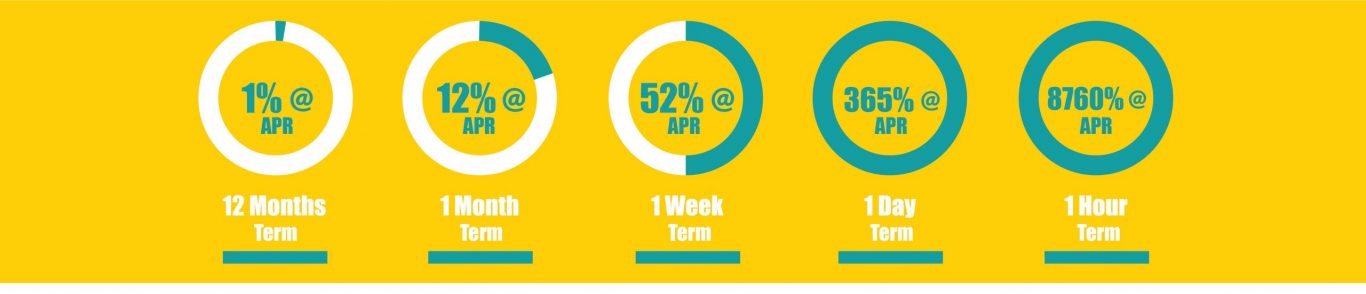

Many people believe that APR accurately demonstrates the cost of a small, short-term Traditional Installment Loan. It does not. APR simply does not provide a clear comparison for small, short-term loans because APR is more a measure of time than of cost.

Let’s look at an example:

Let’s say you borrow $100 and agree to pay back $1 in interest. Seems fair, right? What is the APR of the agreed-upon $1 in interest charges? Well, it depends entirely upon when you pay back the money you borrow. The quicker you pay it back or, put another way, the shorter the term of your loan, the higher the APR.

Thus, APR can be a confusing indicator of the affordability or fairness of a short-term Traditional Installment Loan and, despite what you may hear, it is not a useful measure for all consumer financial products.

Can I get a traditional installment loan with poor credit?

At Security Finance, we do not require our customers to have perfect credit in order to be approved for an installment loan. Our expert team wants to help guide you to the best solution for your financial needs and match you with the most appropriate, affordable monthly payment available.

Where can I get more information about how loans and payments impact my credit score?

The Consumer Financial Protection Bureau provides tools to help consumers understand their credit reports and credit scores at https://www.consumerfianance.gov/consumer-tools/credit-reports-and-scores/.

How do I apply for an installment loan?

Start your personal installment loan process in three easy ways:

1

Start the process with the online

loan inquiry. Once the form is

submitted, we will contact you for the next steps. START NOW

2

Call your nearest branch to start your loan application today. CALL NEAREST BRANCH

3

Visit your nearest branch to speak with a representative in person. They will walk with you every step of the way to make your loan process easy and fast. FIND A LOCATION